Will mortgage rates go down in June?

After being a spectator to a swinging mortgage rate since 2022, let us check what our experts have to say about rates in June.

The average mortgage rate for 30-year fixed loans rose as on 28th May to 7.30% from 7.16% last week, according to data from Curinos. This is down from last month’s 7.35% and up from a year ago when it was 5.48%.

The mortgage rates for 15-year fixed loans inched up as on 28th to 6.52% from 6.38% last week. Today’s rate is up from last month’s 6.46% and up from a year ago when it was 4.67%.

Expert mortgage rate predictions for June

Molly Boesel, principal economist at CoreLogic

Prediction: Rates will moderate

“Consumer inflation continues to be a driving force in interest rates. The recent Federal Reserve announcement signals that there isn’t enough confidence that inflation will continue to drop toward the 2% target. While monetary easing should come later in the year, mortgage rates most likely won’t see any meaningful drops in 2024. Look for the 30-year mortgage rate to remain in the low-7% range in June.”

Craig Berry, branch manager at Acopia Home Loans

Forecast: Rates will moderate

“With inflation resurging, the Federal Reserve is continuing to refrain from further rate cuts, at least for now, fearing a resurgence in price hikes. Thanks to the perfect storm of dogged inflation, increasing treasury yields and the Fed’s run-off of its mortgage backed securities holdings, mortgage rates are likely to stay on pace with where they’ve been in recent months. The caveat, however, could be a strategy the Fed is implementing in June with hopes of influencing mortgage rates: reducing the amount of money in the banking system and allowing rates to naturally rise. This move could mean lower rates as we get further into June and July.”

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will moderate

“The Fed signaled this past meeting that they will not be raising rates in the coming quarters, which I believe will be for the rest of 2024. There seemed to be more of a calmness from Fed Chair Powell in regards to current inflation and consumer spending levels. It leaves the door open for a possible rate cut later in the year and we are seeing other countries like England infer that a cut is coming. This could impact our decision making as a country. I believe we will see rates hold steady in June.”

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

“The biggest tone-setter in the direction of mortgage rates in recent months has been from the inflation data. With inflation still hovering above the Fed’s 2% target, and heading the wrong direction in recent months, mortgage rates had trended higher through May when the Fed meeting and a softer inflation report brought mortgage rates a bit lower. The May inflation data out Wednesday May 15 will give the biggest insight into the likely path ahead for rates.

In the big picture, I anticipate slowing inflation and economic growth that enables mortgage rates to ease back toward the 6.5% range at the end of 2024. Whether we’ll see sufficient improvement in inflation in June to usher in that trend is still unknown. Recent upticks in consumer inflation expectations from several different consumer surveys could be a harbinger of an uptick in price growth in April. If that materializes, we could see mortgage rates reverse course and head back toward the mid-7% range. Because there is such a wide range of very plausible outcomes for mortgage rates in the months ahead, it’s important for home shoppers to rate-test their budget. Shoppers can use mortgage calculators to consider what mortgage rates as low as 6.9% or as high as 7.5% could mean for their monthly payment and home price target.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will fall

“Recent dips in Treasury and mortgage rates, triggered by a cooling job market and the slowest pace of wage growth since 2021, hint at potential further reductions in mortgage rates if inflation continues to make progress towards the Federal Reserve’s 2% target. However, should inflation remain stickier than anticipated, it would bolster the Fed’s stance on maintaining higher rates for longer.”

Rick Sharga, CEO at CJ Patrick Company

Prediction: Rates will moderate

“There’s virtually no chance that the Federal Reserve will cut interest rates at its June meeting, and it’s highly unlikely that mortgage rates will decline meaningfully before a Fed Funds rate cut. So the most likely scenario is that while the Fed continues its “higher for longer” strategy, 30-year fixed-rate mortgages will continue to fluctuate between 7.0-7.5% in June, and for the foreseeable future beyond that.”

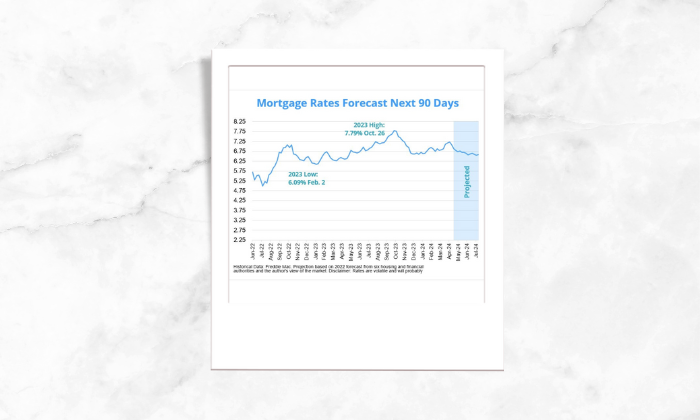

Mortgage interest rates forecast next 90 days

Mortgage rate predictions for 2024

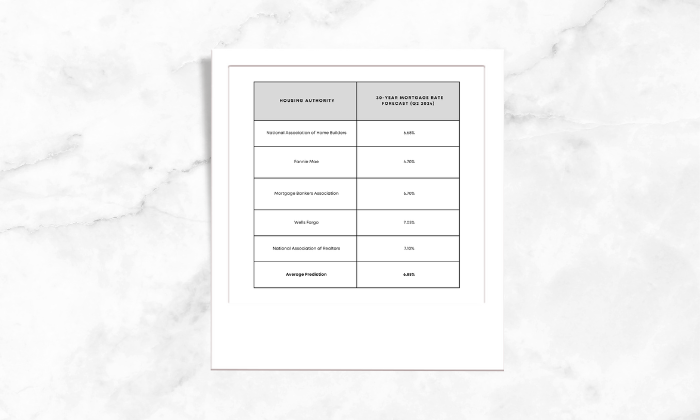

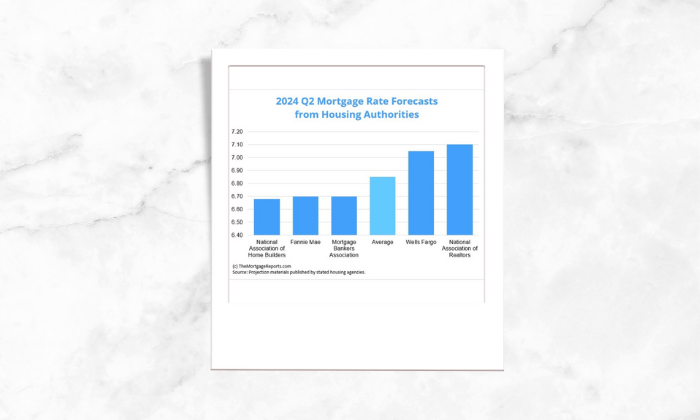

All five major housing authorities we looked at project 2024’s second quarter average to finish below that.

The Mortgage Bankers Association and National Association of Realtors sit at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.68% for Q2. Meanwhile, the National Association of Realtors had the highest forecast of 7.10%.

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. So, if you are in a dilemma to go ahead or stay put, don’t lose too much sleep over it. You can still get a good deal, historically speaking — especially if you’re a borrower with strong credit. Just make sure you maintain a good credit score.

Rest for everything else to find your dream home we are right here.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.