Will mortgage rates go down in March?

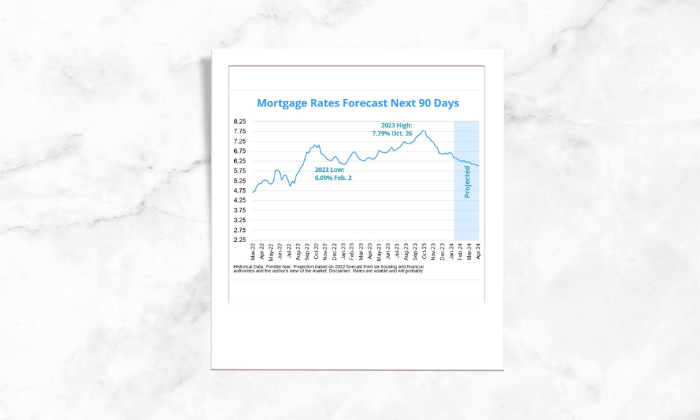

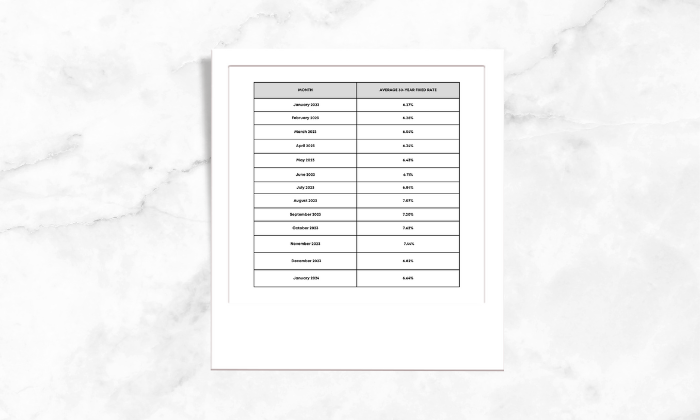

Mortgage rates fluctuated significantly in 2023, with the average 30-year fixed rate going as low as 6.09% on Feb. 2 and as high as 7.79% on Oct. 26, according to Freddie Mac.

Interest rates are notoriously volatile and could tick back up on any given week, However, with so much of fluctuations owing to the volatility in the economy, we might have already seen the peak of this rate cycle.

Experts from CoreLogic, Home Qualified, Realtor.com and others weigh in on whether 30-year mortgage rates will climb, fall, or level off in March.

Mortgage rate forecasts for March by Experts

Molly Boesel, principal economist at CoreLogic

Forecast: Rates will remain in the high 6% range

“The Federal Reserve has taken a pause on interest rates as they monitor inflation, and those looking for decreases in rates will need to be patient. When inflation approaches the Fed target, rates should start to decrease. Until then, look for the 30-year mortgage rate to be in the high-6% range in March.”

Selma Hepp, chief economist at CoreLogic

Forecast: Rates will remain stable

“The US economy continues to show signs of strength, so therefore, rates are likely to remain stable through the spring home buying season, with cuts not expected until the beginning of summer. However, in recent industry surveys, home buyers are beginning to feel optimistic about where rates are heading and more and more home buyers are anticipating rates to decline through the year.”

Rick Sharga, CEO at CJ Patrick Company

Forecast: Rates will moderate

“The consensus is that the Federal Reserve will hold steady at its March meeting, neither raising nor cutting the Fed Funds Rate. Mortgage rates on 30-year fixed rate loans in March will likely do the same, neither rising or declining very much, staying in a fairly narrow band between 6.5-7.0%, fluctuating with reports on various economic metrics.

The sudden dip in rates in the month of January appears to have been an overreaction by the market to language from the Fed that was interpreted as a sign of rate cuts as early as the first quarter. With that increasingly unlikely to happen, we’ve seen mortgage rates inch back up, and are likely to see them zig zag in a gradually downward direction for the rest of the year, but not drop meaningfully until the first rate cut by the Fed actually happens.”

Hannah Jones, senior economic research analyst at Realtor.com

Forecast: Rates will remain in the high 6% range

“Mortgage rates are likely to remain steady through March, dependent on incoming economic data. At the February FOMC meeting, Chair Powell emphasized that it is unlikely that we will see a rate cut in March as incoming economic data remains fairly strong. Later the same week, January employment data came in well above expectation with the economy adding 353,000 net new jobs in the month. The still-strong employment data demonstrated that slowing the economy may not be a straight path, and prolonged contractionary policy may be necessary. Mortgage rates are likely to remain in the mid to high 6% for the time being until slowing inflation shifts investor expectations and the Fed starts to cut interest rates.”

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will remain high

“So far, the first quarter of 2024 has been very similar to the first quarter of 2023. Inflation has been up in some categories and made rates move more upward than downward. Rates came down at the end of 2023 but the most recent Fed meeting should sign that there won’t be any rate cuts until summer 2024. I believe that lack of commitment to cut or raise by the Fed will keep the market guessing and we will see averages creep up some. The 30-year fixed rate will average 7.25% in March while the 15-year fixed will average 6.75%.”

Jess Kennedy, COO at Beeline

Forecast: Rates will moderate

“We predict that rates will hold relatively steady in March. The Fed has signaled pretty strongly that they are in a holding pattern right now. We may see slight fluctuations but generally, we don’t expect much movement. The 10-year bond and 30-year mortgage rate spread continues to be pretty large and we don’t anticipate that to change any time soon since the Federal Reserve is no longer buying MBS, so the demand for MBS is lower.”

Odeta Kushi, deputy chief economist at First American

Forecast: Rates may rise further

“The average 30-year fixed mortgage rate has fallen in recent months, but ticked up again recently due to strong economic and labor market data. Initial optimism for Federal Reserve rate cuts was tempered after recent data, prompting the increase in mortgage rates. Traders have now ruled out a March rate cut, yet May could still see a reduction. This suggests potential mortgage rate volatility ahead, dependent on future economic data. Should this economic data exceed expectations, rates may rise further. Nonetheless, ongoing deceleration in inflation fuels cautious optimism for a general decline in mortgage rates in 2024, especially in the latter half of the year.”

Charles Williams, CEO at Percy

Forecast: Rates will moderate

“In a recent interview on 60 Minutes, Fed Chair Jerome Powell gave a strong indication that they won’t be cutting rates before the economy hits the target rates of 2%. With jobs numbers still very strong, it’s not likely we’ll see a rate cut until March, perhaps even May. And even then, it will be a slow and gradual pullback, so we’ll be lucky to dip below 6% mortgage rates by the end of the year.”

Mortgage interest rates forecast next 90 days

Owing to the high inflation in 2022, the Federal Reserve took stringent actions to bring it down and that led to the average 30-year fixed-rate mortgage spiking a 23year high in 2023.

While the inflation is gradually showing signs of cooling, the Fed adjusted its policies with skipped hikes and we can expect some cuts towards the later half of this year. Additionally, the economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in 2024.

Of course, rates could rise on any given week or if another global event causes widespread uncertainty in the economy.

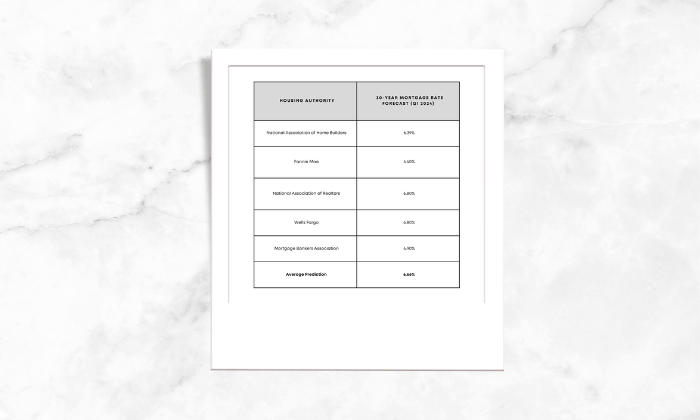

Mortgage rate predictions for 2024

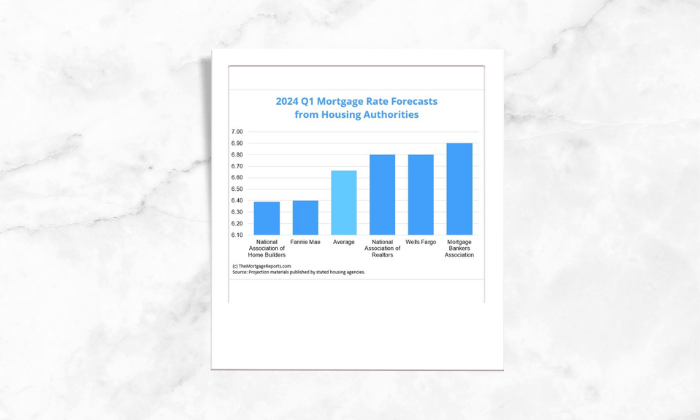

The 30-year fixed-rate mortgage averaged 6.64% as of Feb. 8, according to Freddie Mac. Two of the five major housing authorities we looked at project 2024’s first quarter average to finish below that.

The National Association of Home Builders sits at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.39% for Q1. Meanwhile, the Mortgage Bankers Association had the highest forecast of 6.9%.

Source: Freddie Mac

Current mortgage interest rate trends

The average 30-year fixed rate rose from 6.63% on Feb.1 to 6.64% on Feb. 8. Meanwhile, the average 15-year fixed mortgage rate fell from 5.94% to 5.90%.

Rates have gone high and low in past years too, as history repeats, we can again expect the rates to go down. As we witnessed, that after hitting record-low territory in 2020 and 2021, mortgage rates climbed to a 23-year high in 2023. However, owing to recent economic developments many experts and industry authorities believe they will follow a downward trajectory into 2024.

Whatever happens, interest rates are still below historical averages. So, just make sure you connect with best agent to help you sail through the purchase journey of your most prized possession.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.