Will mortgage rates go down in April?

Insights from Economists: Detailed Predictions for Mortgage Rates in April 2024

Dr. Lisa Sturtevant – chief economist, Bright MLS.

Prediction: Rates will moderate

“The Federal Reserve has indicated that there will likely be cuts to the short-term federal funds rate in 2024, which will put downward pressure on mortgage rates. Overall, though, rates are expected to remain above 6% throughout [2024].”

Melissa Cohn – Mortgage regional vice president, William Raveis.

Prediction: Rates will moderate

“The peak in mortgage rates is behind us, but mortgage rates are not going to decline as fast as everyone would like them to. … The Fed and the markets will now closely analyze all data, and when there is a consistent flow of weaker data, the door will be opened for the Fed to initiate their first rate cut, hopefully, at the end of the second quarter.”

Odeta Kushi – Deputy chief economist, First American.

Prediction: Rates will decline

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

Dan Burnett- Head of investor product, Hometap Equity Partners.

Prediction: Rates will decline

“While softening economic data and indications from the Fed hint that the rate cut cycle could begin sooner than expected, it is worth proceeding with caution as it pertains to mortgage rates. Fed policy will be contingent on continued progress on inflation. If current trends continue, consumers can expect to see Treasury yields decline and mortgage rates come down along with them.”

Skylar Olsen – Chief economist, Zillow.

Prediction: Rates will decline

“I’m expecting mortgage rates to be a bit less volatile in 2024 and, data surprises aside, continue to slowly ease down over the course of the year.”

Craig Berry, branch manager at Acopia Home Loans

Prediction: Rates will moderate

“February’s job reports won’t do much in terms of the Fed changing any of their upcoming moves. Job growth is a good thing. But when combined with the report of higher wages, these conflicting signals won’t translate to much economic movement. Mortgage rates in April will remain relatively level and consistent to the rates in February and March.”

Molly Boesel, principal economist at CoreLogic

Prediction: Rates will moderate

“Slowing of inflation and the ending of the Federal Reserve’s tightening cycle suggest that the peak of mortgage rates is behind us. When Federal Reserve rate cuts begin to be priced into long-term rates, expect mortgage rates to gradually fall. Until then, the 30-year mortgage rate should remain in the high-6% range in April.”

Mark Fleming, chief economist at First American

Prediction: Rates will moderate

“Mortgage rates will likely move sideways in April, since it’s highly unlikely that the Federal Reserve will either raise or lower its benchmark rate in March. Any movement in mortgage rates is likely to depend on any changes in the 10-year Treasury yield over the course of the month.”

Rick Sharga, CEO at CJ Patrick Company

Prediction: Rates will moderate

“Mortgage rates on 30-year loans in April are likely to be very similar to the rates we’ve seen during the first quarter of 2024, fluctuating just above and just below the 7% mark. We may see rates dip a little bit lower if we get reports on inflation, unemployment, and wage growth that align with the Federal Reserve’s goal of slowing down the economy in order to get inflation firmly under control. But we’re not likely to see mortgage rates in the low 6% range until the Fed actually starts cutting the Fed Funds rate later this year.”

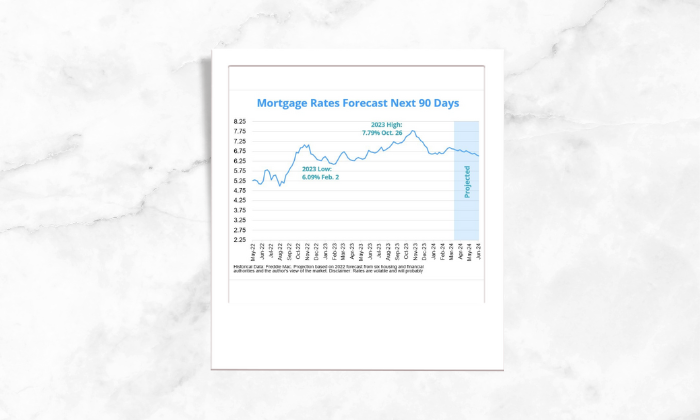

Mortgage interest rates forecast next 90 days

Owing to the high inflation in 2022, the Federal Reserve took stringent actions to bring it down and that led to the average 30-year fixed-rate mortgage spiking a 23year high in 2023.

While the inflation is gradually showing signs of cooling, the Fed adjusted its policies with skipped hikes and we can expect some cuts towards the later half of this year. Additionally, the economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in 2024.

Of course, rates could rise on any given week or if another global event causes widespread uncertainty in the economy.

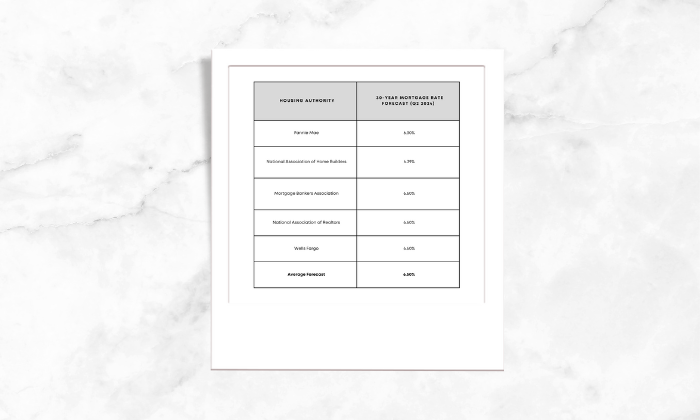

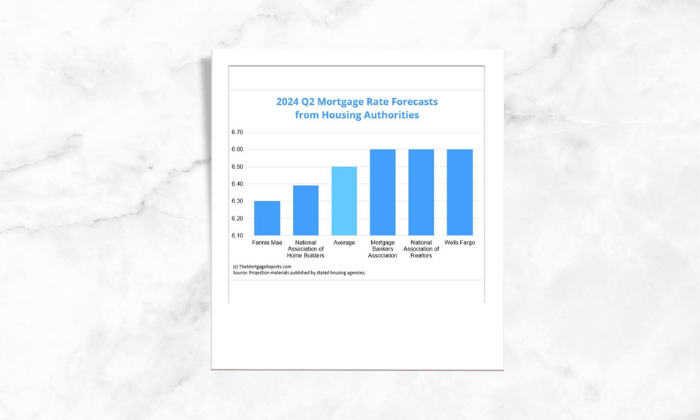

Mortgage rate predictions for 2024

The 30-year fixed-rate mortgage averaged 6.79% as of March 28, according to Freddie Mac. All five major housing authorities we looked at project 2024’s second quarter average to finish below that.

The Fannie Mae sits at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.3% for Q2. Meanwhile, the Mortgage Bankers Association, National Association of Realtors and Wells Fargo had the highest forecast of 6.6%.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.