The Ticking Clock with The Stumbling Block

Hi Readers,

Have you ever experienced that your Agent assessed your loan amount but the sanction came much lower? My buyers experienced the same and here is the story of how it was dealt with & ultimately, the buyers got their dream home availing the originally assessed loan amount.

Happy Reading!!!

--

Introduction

The phone beeped and I checked the message I received. “Hi Madhu, this is Jignesh. I got your coordinates from Zillow. “

Jignesh had been searching through www.zillow.com for a property at East Bay and screened several of my reviews to choose to work with me. He chose to connect with me in order to take a tour of the property. So as discussed, we went to see the property at East Bay. However, he wasn’t much impressed with that property and we continued over other searches.

My yet another property searching journey started with Jignesh & Urvi. They were from India and now live in California. A very young couple in their late 20s. Jignesh & Urvi were a newlywed couple and wanted to shift to the East Bay area from Austin. They had complete clarity in what they wanted for their house, they requested me to show modern & contemporary properties which were very newly constructed with construction age between 1 to 5 years.

As a prudent practice, I inform all my clients of the pros and cons of any property type they want to have a look at. Hence, I informed them that newer properties are generally 3 stories home and further explained to them its benefits & disadvantages. We continued with our search and after seeing two more properties I finally met Jignesh’s wife Urvi, a cute wonderful lady. Prior to this, I have had a word with her over the phone. We immediately connected.

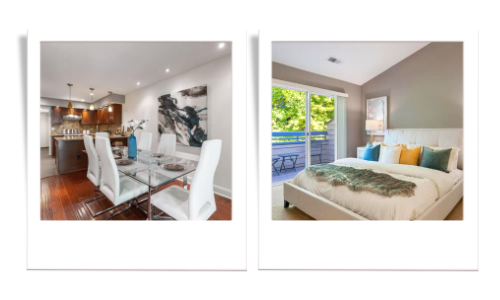

The Search

We kept the search on and looked at few more properties, some they liked, some weren’t matching their checklist. All of a sudden, a property caught their attention, which was not even a single point match with their checklist – it was a Town Home. Now they wanted to see Town Homes with little patio/ backyard. I was startled by their shift of choice. However, I could understand that they loved the concept of owning a land, an independent home with a small backyard, where they can enjoy their quite times together, bar-b-que, gardening, etc. I could appreciate their feeling that these homes give you a feeling of more free and independent living.

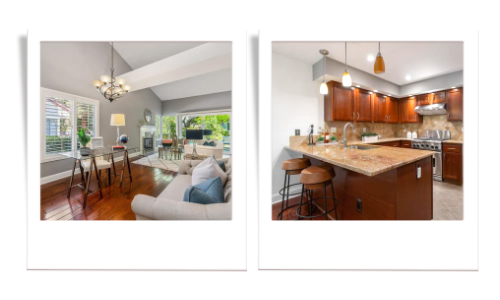

However, as a protocol, I apprised them that these aren’t single-family homes. And though you do not own the land but these townhomes have little backyards and give you the feel like an independent home. Further, I informed that their age of construction would be 15 years – 20 years and you won’t find them in newer construction. These homes don’t give you a feeling of staying in an apartment or something very closed. The entire home is yours, completely yours. Even, the resale value would be much higher.

The Selection

Jignesh and Urvi firmly decided to look for Town Homes now.

After screening number of properties, finally, they liked a house and we immediately made an offer. Alas!!! To our utter dismay, someone else had overbid us by $200,000. The market was soaring & the interest rates are so low, people are ready to pay through their nose for such homes. Urvi was disheartened with all these and I assured her that something better must be waiting for her.

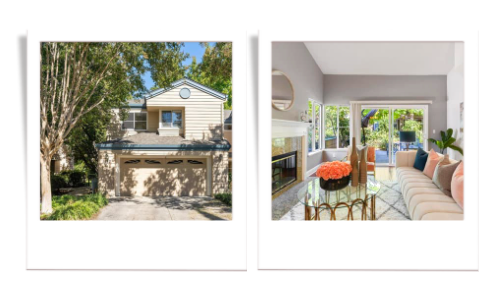

Then after looking at few more properties, we finally arrived at a Town Home in Bayreassa. They really liked the property. It was beautiful and updated with all amenities they wanted. They narrowed it down to this property. So, with their go-ahead, I started talking to the agent, who was a very nice and helpful person. As decided, we made an offer at $1.3 million and waited. The agent responded that the seller is expecting much higher offers, at least another 50k. I again consulted back with my buyers and asked if they could stretch higher. However, Jignesh & Urvi were extremely firm on the upper cap of the price. They have already offered it all they could and couldn’t go further. Not that they didn’t want to go for a higher offer but they couldn’t offer. $1.3 million was their limit. Offering 50k over and above $1.3 million was beyond their limit however, basis their fondness of the property they could stretch to another 5K if that could make the deal. In that case, that house becomes unaffordable for them because that will lead them to a hand-to-mouth kind of a state.

I went back and informed the Seller’s Agent about my Buyer’s incapacity to bid any higher, since they are really young buyers and also, expressed about the couple’s fondness for the property, that they loved each and every part of it but unfortunately, they have to let it go.

Then by that evening me & the agent had multiple calls and after lot of discussion, she informed that though they have higher offers but considering my profile as a listing agent, my reputation, business tenure, business ethics, acumen, and that I belonged to a full-service company and also that we had given a higher down payment, hence the Agent proposed the Seller to accept our offer over other higher offers.

We were completely astounded by the news. We couldn’t believe our own ears. It took a while for us to come in terms. And I asked Jignesh & Urvi that this is the truth and the Agent is going to send us the acceptance mail in a while and all that they need to do – is just sign it and we are in-contract. We were elated.

The Ticking Clock

The contract was signed on 17th Oct’21 and 18th Nov’21 was decided to be the deal closure day. It was such a great news. At this juncture, for the first time I came to understand that though Jignesh & Urvi are already married, however, the ceremony is pending at their hometown in Gujrat, India. Their ceremony dates are already confirmed and guests have been invited from all over the place and all other arrangements have already been made. Their flight tickets were already confirmed. Urvi had to leave for India on the 12th of November and Jignesh on the 19th of November. The deal to be signed on the 18th of Nov. Very close dates and chancy enough.

However, the first suggestion was for Urvi to give the Power of Attorney to her husband Jignesh and then leave for her hometown. They did it accordingly.

The property needed financing and the loan agent was approached with all requisites for processing it further. I calculated all things precisely. We were confident that the appraisal wouldn’t come less than $1.29 million. The reason behind this confidence was that a house got sold just 15 days back in the same complex, with the same layout and that property was appraised at $1.29 million. It was an apple-to-apple comparison and I had been confident on my part. Hence, I apprised Jignesh & Urvi, that they should get the financing for $1.3 million, at the least It could be $1.29 million. Then in that case the difference amount of $10K needs to be paid by the couple and they happily agreed.

The Stumbling Block

As per protocol, the Loan Agent was to send a Third-party for appraisal of the property. Accordingly, the appraisal was done. However, post that it took a long time of 10 days for the final report to arrive. It was the 11th day and we had another 10 days left in hand. When we received the report, we were completely shocked seeing at the loan sanction documents, since the amount which was offered as loan was 30k less, and was $1 million only.

I informed the couple about the same and since they had a time crunch, they immediately agreed to put the 30k from their own pocket. But I knew that the situation will get extremely tough for them to manage all other expenses. Here they are purchasing a new house, invariably that will involve lots of new purchases, movements and will obviously incur cost. To top that they are funding their own wedding ceremonies back home. This will lead to tremendous stress, anxiety, and pressure for these young earners.

However, I couldn’t accept this and scratched my head, as to where and how did I go wrong in my calculation. I had a feeling that something was amiss. I had to get my hands on it. So, I started reading the entire loan reports in detail. To my utter shock, I found that the appraiser has made a mistake while calculating the area of the living space. Since he calculated the living area lesser and multiplied it by price per sq. ft. hence, the total amount has gone down so badly. Otherwise, it would have fetched $1.3 million, if properly appraised.

That very moment, I called Jignesh and stopped him to accept this loan offer and also, not to pay that extra $30k from his own pocket. I knew paying that 30k would have been extremely hard for them considering their wedding ceremony back in India.

I went back to the lender and handed them over the erroneous report and denied accepting the same unless rectified. They agreed to the mistake but said it would take another 10 days to get the same done. It seemed ridiculous. Jignesh had to leave on the 19th of November and these 10 days would get too costly for them. The 10 days they asked for might extend and Jignesh is not in a position to delay the travel even by a day since all ceremonies are fixed. We are also not sure what would the reappraisal would be like. It was a non-contingent offer and they for sure don’t want to let go of this property. I fully understood depending on this loan agent, would only lead to anxiety and stress.

The Splendid End

The only way out for me was to change the loan agent and I knew that there was only one person who could save us – Niki. She is an excellent loan agent. She knows her work too well however she is quite strict, precise and isn’t a party to the group of sweet talkers. On the other hand, Urvi is extremely soft-spoken and loves to be dealt politely.

To get this done in such a short span I suggested Jignesh & Urvi to approach Niki. We couldn’t wait further. On that 11th day itself, instant decisions were taken. And I got them introduced the same day and apprised Niki of the urgency and requested her to get this done since she is the only one who could make this happen. Also made Urvi understand that how she behaves shouldn’t matter to her because at the end of the day she can take you closer to your destination. Just take it in your stride and follow her instructions. What should matter to you is the sanction of loan amount and nothing else at this point else you have to pay that 30k from your own pocket.

Niki took it at top priority and got the appraisal done. Wow!!! Bang on. It got a sanction amount of $1.3million. Now, they will not have to pay anything from their pocket. Urvi left happily for India on 12th November.

Me & my loan agent Niki were on top of it and were able to close the deal on the 17th of November, 1 day ahead of our earlier schedule. Me & Niki had put our best foot forward and ran from pillar to post to get this deal closed on time. This 1 day held a lot of value to Jignesh at that hour, it meant a lot of savings. If the deal had closed on 18th Nov, he would have to put all his furniture from Austen to another storage and shifted them back to this house only after they arrive back from India. It would involve lot of cost and also lot of movements which would have been a little worrisome schedule for this couple.

From Satisfaction to Delight

We got the deal closed on 17th November at 12 noon and congratulated Jignesh. Immediately, I told him to cancel all movers he had booked, since it takes only 24 hours prior for cancellation of your booking. Also, I could gift him the luxury of time - with 1 & a half days, for him to set up the newly bought house in to his dream home. No more extra movements. All furniture could be set up at their own home now and the newlyweds can enter into their all set new home.

Home Sweet Home

The right agent can guide you to your best property at the best terms possible. I was happy that as an agent I could help my buyers have the best of all things possible and ensured that they had a stress-free trip to India and enjoyed their ceremonies to the fullest.

Review by my aforesaid clients:

"Madhu is amazing! Her working style is very upfront which we loved. Between the first house that we saw and till the date we closed on our dream home it was only a span of 2 months. Madhu is great at giving advice not only on what to buy or not, but also which areas to look at, which type of house to buy, which properties would have higher resale value, and awesome suggestions on home improvements.

At one point we got cold feet after paying the initial deposit and Madhu sat us down and really calmly explained all the pros of buying our property and why it made sense for us to move forward and not doubt our initial thought. She was really comforting and no matter how many times we asked the same questions, she would always answer them!

After that, we had a situation where we needed to switch lenders 10 days before the closing and Madhu recommended a lender to us and worked really hard on making sure we close on time. What's great? We are closing a day earlier!!

I would highly recommend Madhu for anyone looking to buy a place in the Bay Area!!"

--

" Thanks for reading this article and for a hassle-free experience of purchase/sale of home feel free to get in touch".

Categories

- All Blogs (56)

- Current Events (1)

- Directional Guidance (4)

- Food (1)

- Home Buying (20)

- Home Selling (14)

- Insights (1)

- Mortgage (13)

- Real Estate Knowhow (15)

- Real Estate Market (7)

- Real Estate News (9)

- Real Estate Procedural Knowledge (10)

- Real Estate Update (9)

- Success Stories (2)

- Tips & Advice (22)

- Tips on Vastu Shastra (4)

GET MORE INFORMATION