August Rates

Will mortgage rates go down in August?

Expert mortgage rate predictions for August

Jessica Lautz, deputy chief economist at the National Association of Realtors

Forecast: hopeful signs rates will start to fall

"The Fed should react positively to the recent ease in inflation. If so, this will have a ripple effect on the mortgage market. Even as the 30-year fixed recently hit an eight-month high and is brushing 7%, there are hopeful signs rates will start to fall for home buyers in the coming months."

Danielle Hale, chief economist at Realtor.com

Forecast: Rates likely to drift lower.

"With mortgage rates at the upper end of their 2023 range headed into August, they are likely to drift lower in the month ahead. The June CPI data issued in mid-July showed striking improvement in inflation trends. While this is unlikely to deter the Fed from hiking its short-term rate at the end of July, progress on inflation could help the Fed sound more confident that its hoped-for economic soft-landing is in reach."

Ralph DiBugnara, president at Home Qualified

Forecast: Fixed mortgage rates increase

"I believe we will see the 30- and 15-year fixed mortgage rates increase based on the perception that the Fed will be raising rates at least two more times in 2023. Settling at 6.99% on 30-year and 6.25% on 15-year. Rates seem to be trending up over the last few weeks based mostly on the Fed holding off rate rise but promising more raises. With the anticipation of the raise, I don't see any huge move until the Fed speaks and clarifies where they currently see the United States trending for the remainder of the year.

Rick Sharga, president and CEO at CJ Patrick Company

Prediction: Rates likely to stay within the same 6.5-7.0%

"Mortgage rates in August are likely to stay within the same 6.5-7.0% range that they've been in for the past couple of months, maybe edging toward the lower end of that range assuming that the Federal Reserve doesn't do anything unexpected at its July meeting.

This month's better-than-expected inflation numbers coupled with a job market that appears to be softening a little bit provide hope that the Fed will stop raising rates soon, allowing mortgage rates to fall slowly but steadily for the remainder of the year."

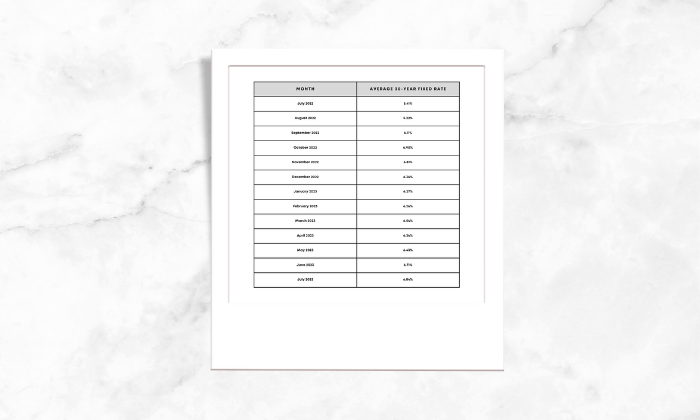

Current mortgage interest rate trends

The average 30-year fixed-rate mortgage (FRM) rose from 6.9% on Aug. 3 to 6.96% on Aug. 10, according to Freddie Mac. Interest rates grew for the third consecutive week.

"There is no doubt continued high rates will prolong affordability challenges longer than expected, particularly with home prices on the rise again. However, upward pressure on rates is the product of a resilient economy with low unemployment and strong wage growth, which historically has kept purchase demand solid," said Sam Khater, chief economist at Freddie Mac.

Mortgage rates went up or down at the beginning of 2023. In the first half, the average 30-year fixed rate went as low as 6.09% on Feb. 2 and climbed up to 6.79% on June 1, according to Freddie Mac.

Mortgage rates increased for the second week in a row.

The 30-year fixed rate rose from 6.9% on Aug. 3 to 6.96% on Aug. 10. The average 15-year fixed mortgage rate also grew, going from 6.25% to 6.34%.

Source: Freddie Mac

Mortgage rates soared to a 14-year high in 2022, after hitting record-low rates in 2020 and 2021. Many experts and industry authorities believe interest rates will follow a downward trajectory in 2023.

McBride says this about the future of mortgage rates:

"With the backdrop of easing inflation pressures, we should see more consistent declines in mortgage rates as the year progresses, particularly if the economy and labor market slow noticeably."

Dating back to April 1971, the fixed 30-year interest rate averaged around 7.8%, according to Freddie Mac. Whatever happens, interest rates are still below historical averages.

So if you haven't locked a rate yet, you can still get a good deal especially if you're a borrower with strong credit. You need to know the right agent to help you sail through this.

--

"Thanks for reading this article and for a hassle-free experience of purchase/sale of home feel free to get in touch".

Categories

- All Blogs (56)

- Current Events (1)

- Directional Guidance (4)

- Food (1)

- Home Buying (20)

- Home Selling (14)

- Insights (1)

- Mortgage (13)

- Real Estate Knowhow (15)

- Real Estate Market (7)

- Real Estate News (9)

- Real Estate Procedural Knowledge (10)

- Real Estate Update (9)

- Success Stories (2)

- Tips & Advice (22)

- Tips on Vastu Shastra (4)

GET MORE INFORMATION