Will Rates Go Down in September 2023?

September Mortgage Rates…. Up, Low, Moderate?

What do our Experts have to say???

Jessica Lautz, deputy chief economist at National Association of Realtors

Forecast: will lower mortgage interest rates in the fall and winter

“In the coming months, with inflation easing, one hopes the Fed will stop rate increases to the federal funds rate, which will lower mortgage interest rates in the fall and winter. In the short term, this is bad news for consumers looking to enter the late summer housing market. Affordability challenges will continue for buyers if new inventory is not brought to the market and rates do not abate.

The increased mortgage rate is exacerbating housing affordability as home prices are climbing in this limited inventory environment. Something has to give for rates to come down, and that something is the next decision by the Fed.”

Jiayi Xu, economist at Realtor.com

Forecast: The Fed is very unlikely to cut the rate anytime soon.

“Mortgage rates will likely maintain their current level of approximately 7%. A sticky inflation rate combined with a declining unemployment rate implies that the Fed is very unlikely to cut the rate anytime soon. Meanwhile, it is worth noting that the Fed is proceeding with caution to make sure the lagged effects of previous rate hikes are fully revealed.

As the CPI shelter index, the largest contributor to the inflation growth has passed its peak and has been on a downward trajectory since April, we may expect a faster inflation slowdown in the coming months. Therefore, it will not be surprising to see the Fed take another “wait-and-see” approach during the upcoming FOMC meeting, which may help alleviate the recent rise in mortgage rates.”

Jess Kennedy, co-founder and COO at Beeline

Forecast: We expect rates to stay steady if not slightly decline in September.

“There is a lot in the news about the almost unexpected strength of the overall US economy. On the back of this, we have seen rates push higher. As these newest reports become reality, we expect rates to stay steady if not slightly decline in September. This is assuming the Fed decides not to increase rates at their next meeting, which appears to be the current sentiment.”

Ralph DiBugnara, president at Home Qualified

Forecast: “I see interest rates overall staying steady at their current levels through September”

“The Fed finally seems to be signaling that we have reached a level, with interest rate raises, that they feel is having the impact they intended the raises to have. Inflation, in most sectors, has started to decrease or stabilize. According to the Consumer Price Index (CPI), the only sector that was truly up over the last few months is real estate.

This is mostly because of a large inventory shortage nationwide. With all of these factors, I see interest rates overall staying steady at their current levels through September. The 30-year fixed rate will settle at around 7% average for the month of September and the 15-year fixed rate will land at 6.375%.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will fall

“Fed policy, inflation, and the health of the labor market determine the outlook for inflation in September. According to the CME FedWatch tool, the odds that the Federal Reserve will pause rate hikes are nearly 90%. If inflation deceleration and labor market cooling continue and the Fed decides to pause rate hikes, there may be some downward pressure on mortgage rates.

The Fed is also expected to release its dot plot projections during the September FOMC meeting. If inflation expectations are higher than expected or the Fed has to take more drastic actions than markets anticipate to tame inflation, mortgage rates may move up.”

Rick Sharga, president and CEO at CJ Patrick Company

Forecast: Mortgage rates will stay between 7.0% and 7.25% through the first half of September

“Mortgage rates, after ranging between 6.5% and 7.0% for the past three months, have risen a bit more than expected in August, due in part to yields on the 10-year U.S. Treasury reaching their highest point this year. The bond market — and the mortgage market — seem to be reacting to a relatively hawkish posture by the Federal Reserve, suggesting that the Fed Funds rate may tick up higher and then stay at that elevated level for longer than many analysts expected.

Given these higher yields on the 10-year bonds and the uncertainty surrounding the Fed’s direction, it seems likely that mortgage rates will stay between 7.0% and 7.25% through the first half of September, and then adjust up or down after the Fed meets on the 19th and indicates what its plans are.”

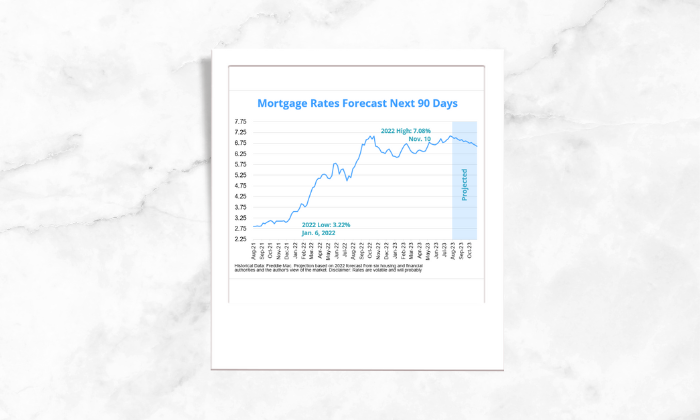

Mortgage interest rates forecast next 90 days

The average 30-year fixed-rate mortgage more than doubled within the course of the year because of the rampant inflation we saw in 2022. In order to bring down the inflation the Fed took action and that led to big interest growth.

With inflation gradually cooling, the size of the Fed’s rate hikes is coming down. There are high indications that mortgage interest rates will move within a tighter range compared to the spikes we saw in early 2022. Of course, interest rates are notoriously volatile and could tick back up on any given week.

Mortgage rate predictions for 2023

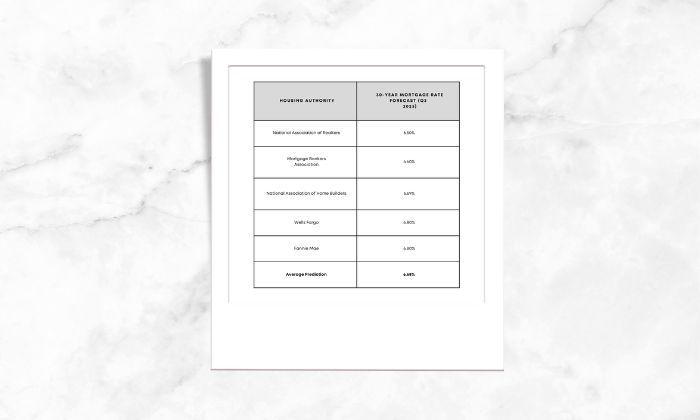

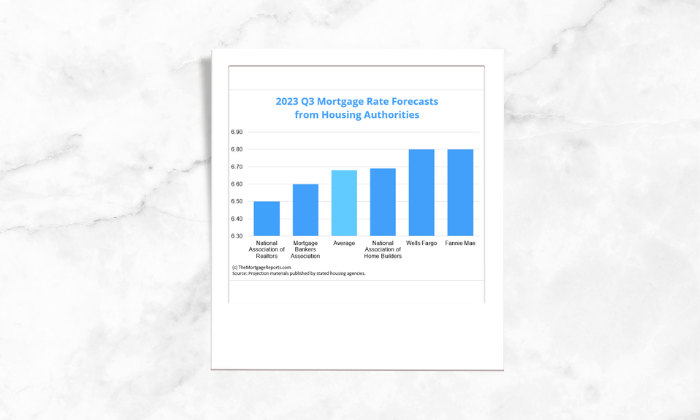

The 30-year fixed-rate mortgage averaged 7.18% as of Aug. 31, according to Freddie Mac. All five major housing authorities we looked at projected 2023’s third-quarter average to finish below that.

National Association of Realtors predicts the lowest average 30-year fixed interest rate to settle at 6.5% for Q3. Meanwhile, Wells Fargo and Fannie Mae have the highest forecasts of 6.8%.

(c) TheMortgageReports.com

Source: Projection materials published by stated housing agencies.

--

"Thanks for reading this article and for a hassle-free experience of purchase/sale of home feel free to get in touch".

Categories

- All Blogs (56)

- Current Events (1)

- Directional Guidance (4)

- Food (1)

- Home Buying (20)

- Home Selling (14)

- Insights (1)

- Mortgage (13)

- Real Estate Knowhow (15)

- Real Estate Market (7)

- Real Estate News (9)

- Real Estate Procedural Knowledge (10)

- Real Estate Update (9)

- Success Stories (2)

- Tips & Advice (22)

- Tips on Vastu Shastra (4)

GET MORE INFORMATION