ESCROW

ESCROW

What is an escrow account?

It is a third-party savings account set up by your mortgage lender or servicer where funds are kept before they are transferred to the ultimate receiving party. It provides security against scams and frauds, especially with high asset value and dispute-prone sectors like Real estate.

Why should you have an escrow account?

Placing the funds in escrow allows the buyer to perform due diligence on the potential acquisition and it also assures the seller that the buyer can close on the purchase.

As a buyer, you have to repay your principal and interest and most lenders will offer or require you to make extra payments into an escrow account to cover costs for your homeowner’s insurance, property taxes, and private mortgage insurance.

Many lenders require that you pay your taxes and insurance using escrow to protect their investment and ensure that bills are paid timely. Your mortgage servicer will manage the escrow account and pays these bills on your behalf. Sometimes escrow accounts may also be required by law.

Benefits of having an escrow account

The biggest benefit of having an escrow account is that you’ll be protected during a real estate transaction – whether you’re a buyer or a seller or a lender. It ensures that no escrow funds from your lender and other property change hands until all of the conditions in the agreement have been met.

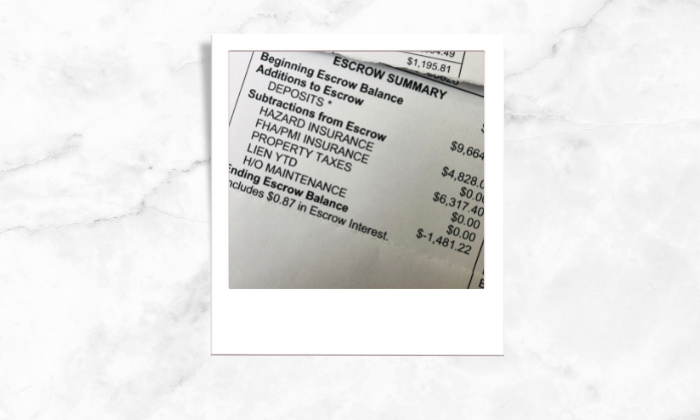

Your mortgage servicer will deposit a portion of each mortgage payment into your escrow to cover your estimated property taxes and your homeowners and mortgage insurance premiums. It helps you in accumulating your money gradually and pay off the above bills when it arrives instead of paying the big bill once or twice a year.

Your excess money

You can’t access the money in your escrow accounts, and banks generally don’t pay interest on your escrow balance. However, In the event of your mortgage closure, you have remaining funds in your escrow account, and you will be eligible for an escrow refund of the remaining balance.

You should consider having an escrow account

Even if your lender doesn’t require an escrow account, consider opting for one voluntarily. An escrow account makes it easier to budget for those large property-related bills by paying in small fragmented monthly payments. That way you don’t have to be under pressure to pay them off in one go when it arrives.

--

"Thanks for reading this article and for a hassle-free experience of purchase/sale of home feel free to get in touch".

Categories

- All Blogs (56)

- Current Events (1)

- Directional Guidance (4)

- Food (1)

- Home Buying (20)

- Home Selling (14)

- Insights (1)

- Mortgage (13)

- Real Estate Knowhow (15)

- Real Estate Market (7)

- Real Estate News (9)

- Real Estate Procedural Knowledge (10)

- Real Estate Update (9)

- Success Stories (2)

- Tips & Advice (22)

- Tips on Vastu Shastra (4)

GET MORE INFORMATION