Mortgage Rates in New Year 2024:

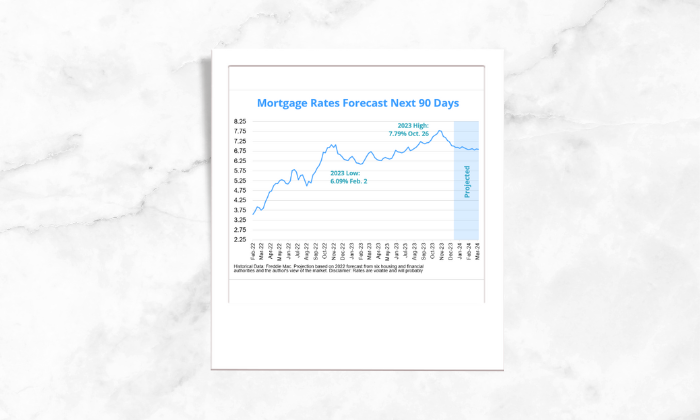

As we are aware that mortgage rates fluctuated significantly in 2023. According to Freddie Mac the average 30-year fixed rate went as low as 6.09% on Feb. 2 and as high as 7.79% on Oct. 26.

With the economy showing signs of slowing, many experts believe mortgage interest rates will gradually descend in 2024.

Let’s have a look at our Expert’s mortgage rate Forecasts for January

Rick Sharga, CEO at CJ Patrick Company

Forecast: Rates will decline

“With inflation moving in the right direction, wage growth slowing, and the jobs market softening a bit, it seems likely that the Federal Reserve has finished rate hikes for this cycle. That, coupled with weakening bond yields, should create an environment where mortgage rates can start a gradual, but steady decline throughout 2024. January rates for 30-year fixed-rate loans will probably straddle 7% — ranging from 7.1% to about 6.9% as the market finds its footing to begin the year.”

Ralph DiBugnara, president at Home Qualified

Forecast: Rates will decline

“Rates finally shifted down some in December and stabilized lower. U.S. payrolls came in lower than anticipated, unemployment was up and building of new homes was down. These are good signs that inflation may have reached its peak and could trigger a lowering of rates. I expect the Fed to stay neutral for the time being and possibly through the first quarter of the year with possible cuts coming only if we see a drastic shift in the economy. For January, I believe the average 30-year fixed will land at 7.125% and the 15-year fixed will be 6.75%.”

Selma Hepp, chief economist at CoreLogic

Forecast: Rates will decline

“Mortgage rates should continue to decline, albeit very gradually and given there are no surprises with inflation. We should see rates fall below 7% mark.”

Craig Berry, branch manager at Acopia Home Loans

Forecast: Rates will decline

“As inflation is the no. 1 item on the Federal Reserve’s radar right now, the Feds may choose not to lower the federal funds rate until inflation comes down. And, while Fed rate cuts aren’t a must-have in order for mortgage rates to come down, interest rates are affected by the federal funds rate.

The Feds continue to seek a balance between inflation and maximum employment so as not to cause significant damage to the economy which could trigger a recession. Recent momentum has been positive, and as long inflation cooperates, mortgage rates may see a slight decline in January. However, it isn’t likely that we’ll see significant drops to longer-term rates until we get further into 2024.”

Odeta Kushi, deputy chief economist at First American

Forecast: Rates will decline

“In light of favorable trends in inflation and labor market data, the Federal Reserve appears to be on a path towards its goals, although achieving its 2% inflation target will take some time. Consequently, the Fed is expected to maintain a restrictive stance, which will keep mortgage rates elevated. However, given slowing inflation and a cooling labor market, and barring any unforeseen developments, modest reductions in mortgage rates are possible in January.”

Jess Kennedy, COO at Beeline

Forecast: Rates will decline

“We expect rates to continue to ease as we kick off 2024. You can see the signaling of a rate cut from the Fed in many ways. For example, it is harder to find long-term CDs at the higher interest rates we were seeing 45-60 days ago). Publicly traded companies are also seeing their stock prices move higher on the expectation of rate relief in 2024. All these signs signal rates start to tick down even ahead of an official rate cut.”

Hannah Jones, senior economic research analyst at Realtor.com

Forecast: Rates will decline

“If inflation and employment data continue to show signs of slowing, mortgage rates are likely to ease in January, though at a slower clip than in recent weeks. As incoming data confirms that the economy is indeed cooling, the upward pressure on mortgage rates will continue to let up and buyers will enjoy lower rates than in recent months.

However, if inflation or employment data come in stronger than expected, we could see rates pick up steam once again. Investors expect the Fed to hold steady at the current target rate in next week’s meeting, which would signal the Committee’s confidence in the current policy stance to bring inflation down to the target 2%. As inflation reaches the target level, mortgage rates will continue to drift lower.”

Mortgage interest rates forecast next 90 days

“Given inflation continues to decelerate and the Federal Reserve Board’s current expectations that they will lower the federal funds target rate next year, we likely will see a gradual thawing of the housing market in the new year,” said Sam Khater, Freddie Mac’s chief economist. Let’s see Freddie Mac’s projection for next 90 days:

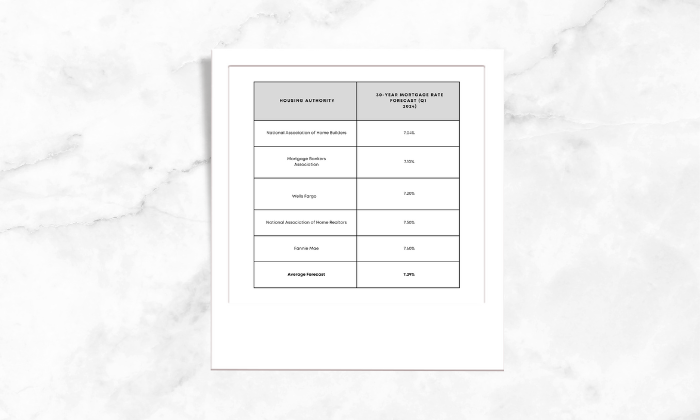

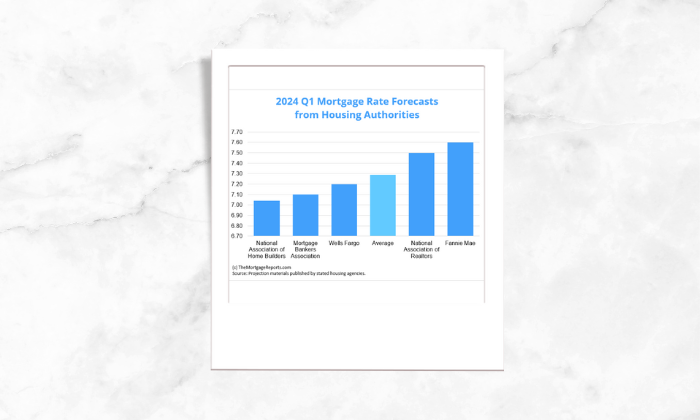

Mortgage rate Forecasts for 2024

The 30-year fixed-rate mortgage averaged 6.95% as of Dec. 14, according to Freddie Mac. As per mortgagereports.com all five major housing authorities projected 2024’s first quarter average to finish above that.

The National Association of Home Builders sits at the low end of the group, predicting the average 30-year fixed interest rate to settle at 7.04% for Q1. Meanwhile, Fannie Mae had the highest forecast of 7.6%.

The mortgage rates have been on a seesaw from 2020 till now, with hitting record-low territory in 2020 and 2021, it climbed to a 23-year high in 2023. We have seen from above statements that many experts and industry authorities believe rates will follow a downward trajectory into 2024. Whatever happens, interest rates are still below historical averages.

Make use of the opportunity.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.