What Is PMI?

While issuing mortgages for first-time homebuyers or for loan refinancing, lenders rely on Private Mortgage Insurance to mitigate their financial risk.

Home -buyers may not always be in a position to make a down payment of 20%, but still they can avail loan by paying Private Mortgage Insurance. Thus, Private mortgage insurance is a type of insurance the borrower may have to pay if they don’t have 20% for a down payment.

When do you require a PMI?

PMI payments are required in two circumstances:

- For conventional loans without a down payment of at least 20%

- For refinancing loans where the loan-to-value ratio exceeds 80%

Borrowers can get some lenders to approve your conventional loan with as little as 3% down. But to protect themselves against this financial risk, they’ll ask borrowers to make monthly private mortgage insurance payments. These monthly payments are usually clubbed together with the monthly mortgage payment.

However, loan programs like USDA & VA Loans don’t require any down payment, nor do they require private mortgage insurance.

How Is PMI Calculated?

Your total private mortgage insurance amount will always be a percentage of your total mortgage. The average PMI costs are between 0.22% and 2.25% of your mortgage. But your exact percentage will depend on your lender as well as your own financial situation in order to mitigate the financial risk the lenders are taking by offering you a loan.

PMI Payment Methods

You can avail for different PMI payment methods, with advantages and considerations for each.

Monthly Premium

This option suits those seeking a lower upfront cost and prefer to budget for a steady, consistent PMI expense. The monthly premium payment structures in a way to spread the insurance cost over the life of the loan by adding a stipulated amount to the borrower’s monthly mortgage payment.

Upfront Premium

The upfront premium payment requires the borrower to pay a lump sum amount at the loan’s origination, potentially reducing monthly mortgage payments and overall interest. It is an attractive choice for individuals with extra funds at the outset and those eager to minimize long-term financial obligations.

Upfront Premium Combination

The upfront premium combination method is a hybrid approach that allows borrowers to pay a partial upfront premium and thus reducing their monthly PMI payment while still enjoying some of the benefits of the upfront approach.

Thus, you can strike a balance between available options and your affordability.

What affects your PMI?

The exact amount of your private mortgage insurance payments will depend on a number of factors. The following factors will influence your rates.

Loan-to-Value Ratio (LTV)

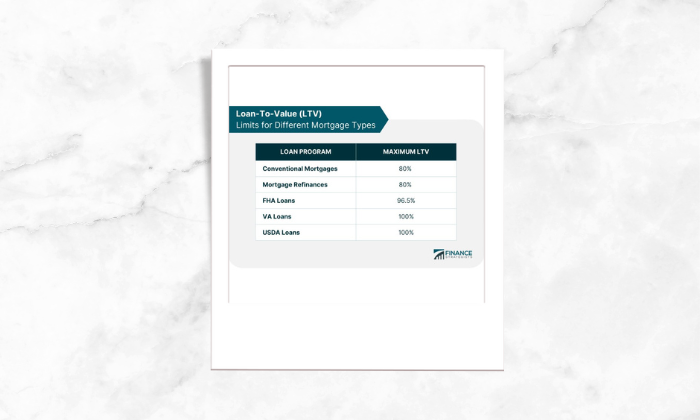

PMI payments can be avoided if your loan-to-value (LTV) ratio is 80% or better. The lower down payment translates into a higher LTV ratio. A higher LTV translates into higher risk for your lender, which means that your PMI rates may increase.

Thus, your LTV directly influences your PMI rates.

Credit Score

Secondly, your credit history affects your PMI payments largely. In addition to your home’s LTV ratio, your lender will also look at your credit history. A strong credit score won’t eliminate your need to make PMI payments , but you may see more favorable rates when your credit score is high.

Debt-to-Income Ratio (DTI)

In addition to the above your debt-to-income ratio affects your PMI.Most lenders are looking for a DTI ratio of 43% or lower. A higher ratio indicates greater financial risk, so your PMI providers may raise the value of your monthly PMI payments.

How to Estimate your PMI?

Your lender can provide you with your expected PMI range. Alternatively, you can use the average range (0.22% to 2.25%) to make an estimate of your expected monthly PMI payments.

To calculate your PMI payments, simply multiply your total loan amount by your PMI percentage. The result is your annual premium. Divide this number by 12 to calculate your estimated monthly payment, though remember that this number will be added to your mortgage premiums.

So for a mortgage amount of $250,000, let’s take a look at your PMI range by multiplying this number by the upper and lower limit:

- 0.22%: $550/year, $46/month

- 2.25%: $5625/year, $469/month

This difference highlights why it’s beneficial to keep your PMI payments as low as possible — or avoid them altogether and here are ways to avoid or minimise.

Ways to avoid PMI

Naturally, you want to avoid PMI payments, which only add to your monthly mortgage premiums. Here are several ways to get out of PMI payments.

Make a 20% Down Payment

The best way to avoid private mortgage insurance is to simply make a traditional 20% down payment. Yes, this can take a bit longer to save, but it will help you avoid the added cost of PMI payments. Additionally, a higher down payment may help you qualify for a larger mortgage and open up better lending options. Choose for a higher down payment as much as possible.

Pursue a Higher-Interest Loan

Since PMI payments and interest payments actually serve the same purpose — they both protect lenders when issuing large loans such as a traditional mortgage. Hence, before agreeing to PMI Payments weigh your options. Loan with PMI Payments or loan with higher interest. You may be able to avoid costly payments by agreeing to a higher interest rate. Opt for the one which saves your money.

Consider Other Loan Options

Shop for other loan options if you are not ready with 20% down payment. USDA loans and VA loans don’t require any down payment, though each has its own eligibility requirements.

The same can’t be said for loans backed by the Federal Housing Administration (FHA). Their down payment depends on your credit score. However, FHA loans require you to pay something called a mortgage insurance premium (MIP) that serves the same function as a private mortgage insurance payment.

Conclusion

Private Mortgage insurance payments does add to your total cost and makes your loan costlier with higher repayment schedule. However, it adds up as a necessary expense for homebuyers looking to purchase a home with less than 20% down payment. Because it mitigates the financial risk of lenders who are empowering buyers to find the home of their dreams with lesser down payment.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.