Is this the right time to buy a house?

Many of us considered buying a house in last 1 year or so but backed out on account of unaffordability. And while there’s no disagreement that affordability is still tight, there are signs it’s starting to get a bit better and may improve even more throughout the year.

Elijah de la Campa, Senior Economist at Redfin, says:

“We’re slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines.”

Buying a home is all about your affordability. So,let’s take a look at the three biggest factors that affect home affordability:

mortgage rates, home prices, and wages.

- Mortgage Rates

Mortgage rates along with being volatile this year, had been bouncing around in the upper 6% to low 7% range. And for sure it is quite a bit higher than where they were a couple of years ago. But there is still a sliver lining .

Despite the recent volatility, rates are still lower than they were last fall when they reached nearly 8%. On top of that, most experts still think they’ll come down some over the course of the year.

A recent article from Bright MLS explains:

“Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.”

Any drop in rates makes a difference in your affordability. You can afford the home you really want more easily because your monthly payment would be lower due to lower rates.

- Home Prices

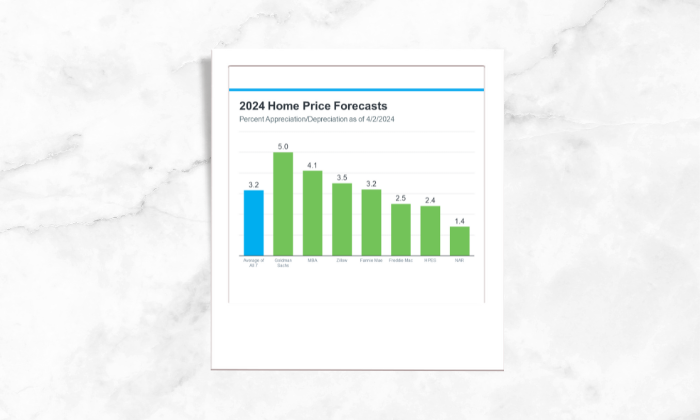

The second big factor towards affordability is home prices. Because of the low inventory most experts project home prices will keep going up this year, but at a more normal pace. Though there are more homes on the market this year, but still not enough for everyone who wants to buy one. The graph below shows the latest 2024 home price forecasts from seven different organizations:

These forecasts are actually good news and an alarm for you because it means the prices aren’t likely to shoot up sky high like they did during the pandemic but it also doesn’t mean they’re going to fall – they’ll just rise at a slower pace.

- Wages

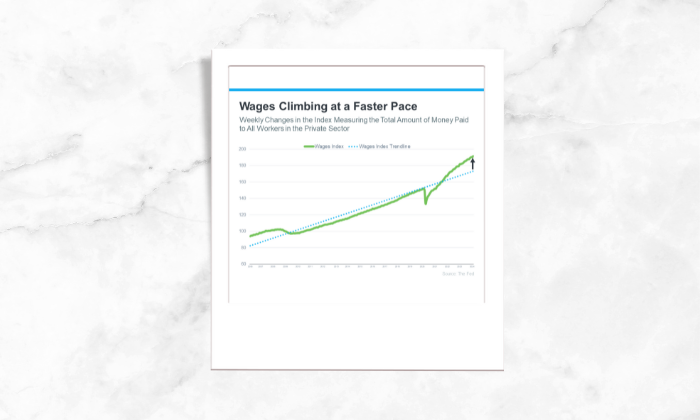

The third factor for affordability is your income. That is your source of owning a house. And data says that wages have been growing over time which is helping affordability. The graph below uses data from the Federal Reserve to show how wages have been growing over time:

Check out the blue dotted line. That shows how wages typically rise. If you look at the right side of the graph, you’ll see wages are climbing even faster than normal right now.

Thus, a higher income makes it easier to afford a home because you don’t have to spend as big of a percentage of your paycheck on your monthly mortgage payment. Also it takes care of your Debt – to- income ration.

Bottom Line

Above trends are a good sign for your ability to afford a home.

Now you need to decide do you still want to wait for a rate correction? Because if you wait, the home prices will increase and again it will have the same affect on your affordability. We are not sure about how much rate correction will happen but for sure home prices will increase. If your income has increased and your DTI ration looks good it’s a good opportunity to grab before you realise you have missed the home of your choice.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.