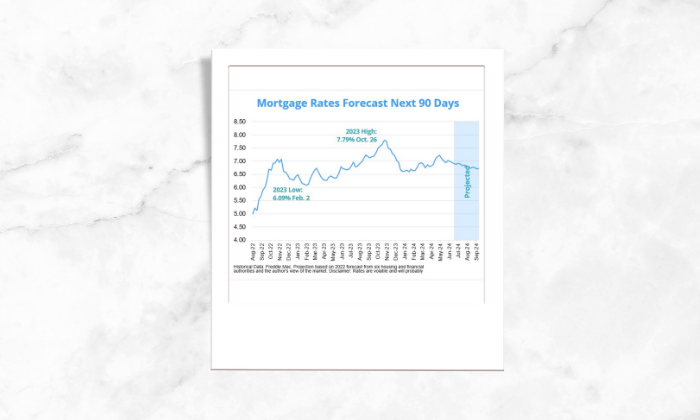

With a background of fluctuating mortgage rates since 2023 with rates going as low as 6.09% on Feb. 2 and as high as 7.79% on Oct. 26, according to Freddie Mac.

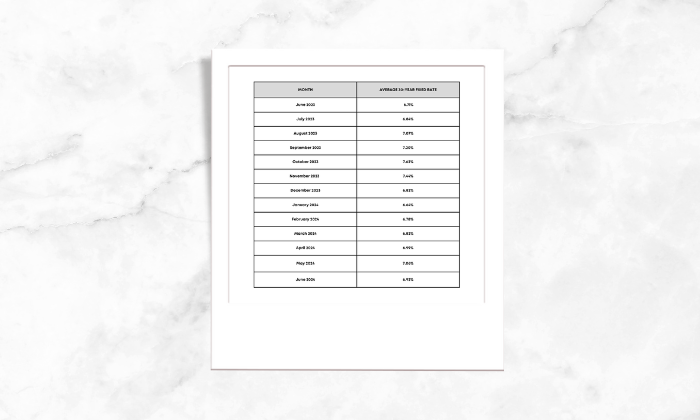

As we observed, mortgage rates peaked for the year in May and we really won’t know what’s in store for sure until the end of December, but the trend has been downward. The 30-year fixed-rate mortgage averaged 7.22% in the first week of May, according to Freddie Mac’s weekly survey. It fell to 6.86% in the last week of June.

The gradual rate decrease was accompanied by declining inflation. If we have a closer look at the core consumer price index, it has fallen from March 3.8% through May 3.4%. Since both are corelated, hence whenever there is a drop in inflation the Mortgage rates tend to drop. So if inflation continues to diminish, mortgage rates might keep falling.

Let’s see what our experts have to say

Expert mortgage rate predictions for July

Ralph DiBugnara, president at Home Qualified

Prediction: Rates will moderate

“The Fed signaled that they are still on target to cut rates once this year. That reassured some of the market of what has been said previously. With that, rates came back down some to where they were in May after the Fed first mentioned a cut. I believe that rates will stay steady where they are averaging now and in July we will see an average 30-year fixed rate of 7% and 15-year fixed at 6.5%.”

Danielle Hale, chief economist at Realtor.com

Prediction: Rates will moderate

“The Fed didn’t do mortgage rates any favors in its June meeting with the economic projections suggesting just one rate cut is now expected in 2024 versus three as recently as March. However, flat consumer price inflation in May and a drop in producer prices suggest that the Fed’s policy is having its intended effect.

This has two likely consequences for mortgage rates in July. First, these data help alleviate the upward pressure that we saw on mortgage rates in the spring when inflation was picking up. Second, while the 2% inflation target isn’t changed, the May progress can change the way investors react to the next inflation reading in July. Another low inflation reading could signal a trend, and help rates build on recent lower momentum, but a higher than expected reading would cause rates to climb.

Put another way, inflation is likely to be the number one friend or foe for home shoppers and those hoping to refinance in the month ahead. Fortunately home shoppers are seeing other market advantages with active listings climbing nationwide. Some markets are seeing greater growth in the number of homes for sale while other markets continue to be relatively competitive.”

Odeta Kushi, deputy chief economist at First American

Prediction: Rates will moderate

“The FOMC will hold off on making any changes to the federal funds rate until they see more evidence of inflation making significant and sustained progress toward the Fed’s target, or there’s an economic downturn or worrisome weakness in the labor market. Sticky inflation and the Federal Reserve’s ‘higher-for-longer’ stance is likely to keep mortgage rates at an elevated and bounded range over the near term.”

Rick Sharga, CEO at CJ Patrick Company

Prediction: Rates will moderate

“The announcement by the Federal Reserve that there will likely be only one cut to the Fed Funds Rate this year — and late in the year at that — increases the probability that interest rates for 30-year fixed rate mortgages will remain in a narrow band between 7.0-7.5% through July, and probably throughout most of 2024. There’s a possibility that rates could dip slightly below that if yields on the 10-year Treasury continue their recent downward trajectory, but that doesn’t seem like the most likely scenario.”

Mortgage interest rates forecast next 90 days

The average 30-year mortgage rate averaged 6.82% in June, down from 7.01% in May, according to NerdWallet’s daily mortgage rate survey. Among factors affecting rates, the most influential was the May consumer price index, which came in below what the market expected.

Thus, with economy showing signs of slowing has many experts believing mortgage interest rates will gradually descend in 2024.

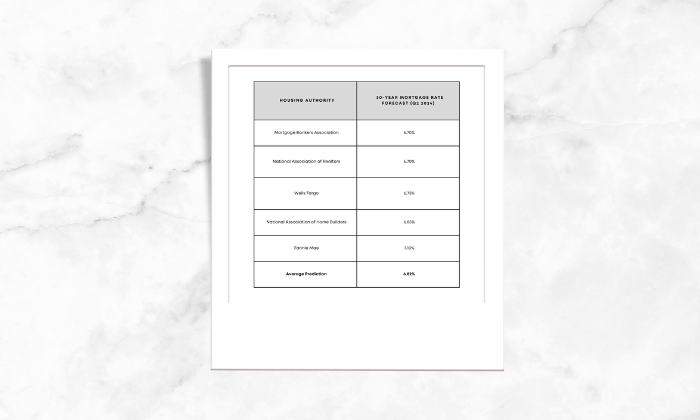

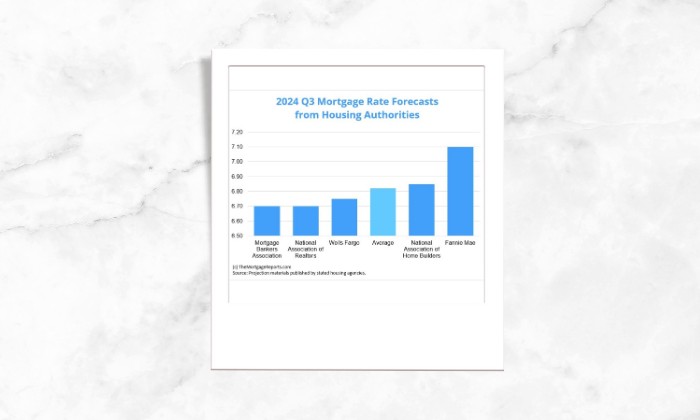

Mortgage rate predictions for 2024

The 30-year fixed-rate mortgage averaged 6.86% as of June 27, according to Freddie Mac. Four of the five major housing authorities we looked at project 2024’s third quarter average to finish below that.

The Mortgage Bankers Association and National Association of Realtors sit at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.7% for Q3. Meanwhile, Fannie Mae had the highest forecast of 7.1%.

Current mortgage interest rate trends

Mortgage rates decreased for the fourth consecutive week, staying below the 7% marker.

The average 30-year fixed rate declined from 6.87% on June 20 to 6.86% on June 27. However, the average 15-year fixed mortgage rate grew, going from 6.13% to 6.16%.

Source: Freddie Mac

The median home resale price hit an all-time high of $419,300 in May (the latest data available), according to the National Association of Realtors. Meanwhile, the average mortgage rate in May was around 7%.

“Slightly more inventory, weaker demand, you’d expect price reductions to be climbing — and in fact, price reductions are, indeed, climbing,” Mike Simonsen, president of real estate analytics firm Altos Research said in his June 25 weekly market commentary on YouTube, explaining that 36.9% of the homes currently on the market have cut their asking prices and that means prices could be softening.

Home prices rise and fall seasonally, and they usually peak in June. Thus, if mortgage rates go down this autumn, as expected, the combination of lower home prices and interest rates could make homes a bit more affordable.

Contact your agent soon to grab this opportunity.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.