Will mortgage rates go down in August?

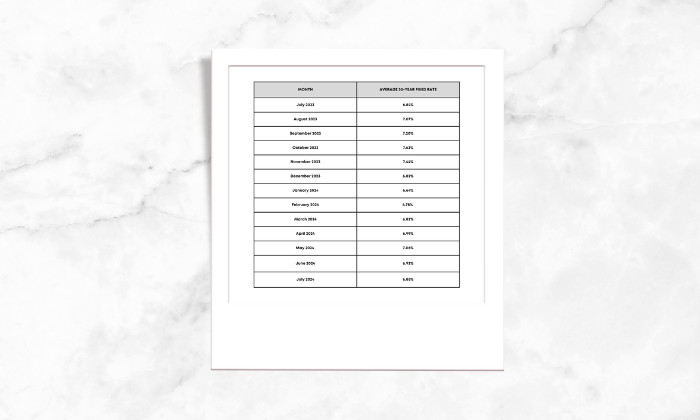

Average 30-year fixed mortgage rates nearly reached 8% in the second half of 2023, but finally fell below 7% in mid-December. This year mortgage rates remained consistently below 7% until late April, when they crept up to 7.17%. July mortgage rates are sitting just below the 7% threshold as mentioned by lendingtree.com.

On Wednesday, July 31, 2024, the average APR on a 30-year fixed-rate mortgage fell 5 basis points to 6.618%. The average APR on a 15-year fixed-rate mortgage fell 2 basis points to 5.773% and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 2 basis points to 7.592%, according to rates provided to NerdWallet by Zillow. The 30-year fixed-rate mortgage is 16 basis points lower than one week ago and 28 basis points lower than one year ago.

The current national mortgage rates forecast indicates that rates are likely to remain high compared to recent years, but could trend closer to 6% if inflation continues to decrease in 2024.

After being a spectator to a swinging mortgage rate since 2022, let us check what our experts have to say about rates in August.

Experts from CoreLogic, Realtor.com and others weigh in on whether 30-year mortgage rates will climb, fall, or level off in August.

Expert mortgage rate Forecasts for August

Molly Boesel, senior principal economist at CoreLogic

Forecast: Rates will moderate

“The inflation report for June delivered encouraging news and provided some confidence that inflation will continue to drop toward the Federal Reserve’s target. Any large drops in mortgage rates will most likely not occur until monetary easing begins, and while inflation news was positive, there is no indication that easing will happen in the near term. Look for the 30-year mortgage rate to remain in the high-6% range in August.”

Ralph DiBugnara, president at Home Qualified

Forecast: Rates will moderate

“Rates for August should stay around the same range seen through July without any major change coming before the September fed meeting. The anticipation is that based on unemployment, consumer spending and slow growth of the economy, the Fed will look to cut rates for the first time in in the last two years this September. The market, whether it be stocks, commodities, or treasuries, has been betting on this cut for the last few weeks. The 30 year fixed interest rate should average 7% with the 15 year fixed at 6.75% in August.”

Ralph McLaughlin, senior economist at Realtor.com

Forecast: Rates will decline

“[June’s] jobs report was a solid report that suggests inflation is being tamed vis-à-vis moderating employment growth and rising unemployment. This has led investors to believe we’ll get a rate cut by the end of the year, and has helped drive down the 10-year treasury. Although volatile, we should see 10-year treasury rates continue on a downward trend and, as a result, a slow decline in mortgage rates throughout the rest of the year to perhaps the 6.4%-6.6% range.”

Odeta Kushi, deputy chief economist at First American

Forecast: Rates will decline

“Recent positive inflation news and a cooling labor market have increased the likelihood of a rate cut by the Federal Reserve in September, with the potential of another rate cut by year-end. This expectation is already exerting downward pressure on mortgage rates. Should incoming data on labor and inflation support a more dovish Fed, we could see further, albeit gradual, declines in mortgage rates.”

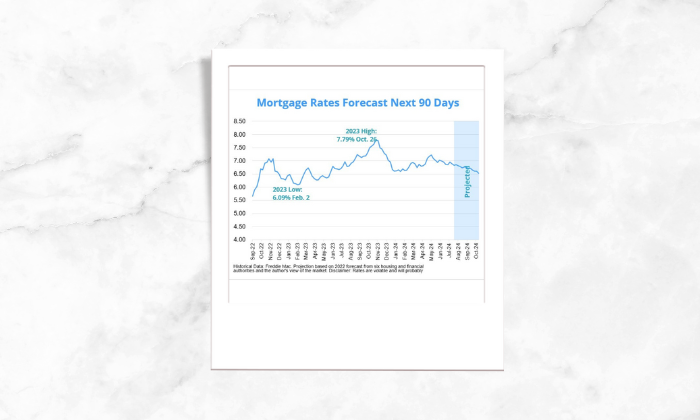

Mortgage interest rates forecast next 90 days

The 30-year fixed-rate mortgage averaged 6.88% through the first four weeks of July, up about one-eighth of a percentage point from June’s average. While rates remain elevated, the Fed recently signaled that it will begin to cut rates in 2024, indicating a further downward shift in mortgage rates may soon come.

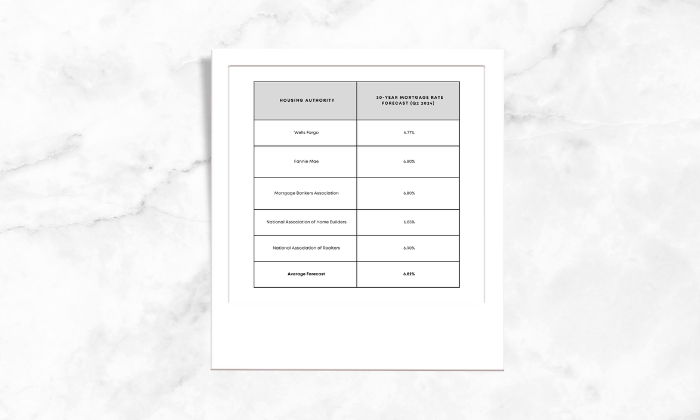

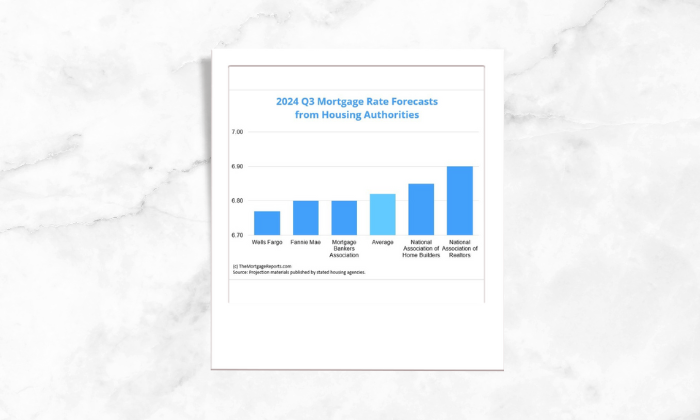

Mortgage rate Forecasts for 2024

The 30-year fixed-rate mortgage averaged 6.78% as of July 25, according to Freddie Mac. Four of the five major housing authorities we looked at project 2024’s third quarter average to finish above that.

Wells Fargo sits at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.77% for Q3. Meanwhile, National Association of Realtors had the highest forecast of 6.9%.

Current mortgage interest rate trends

Mortgage rates inched back up following two weeks of declines.

Source: Freddie Mac

Whatever ups and downs happen, interest rates are still below historical averages. You can still get a good deal, especially if you are a borrower with strong credit.

You cannot time the market and so this is the best time to start your home search.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.