Will mortgage rates go downward in April?

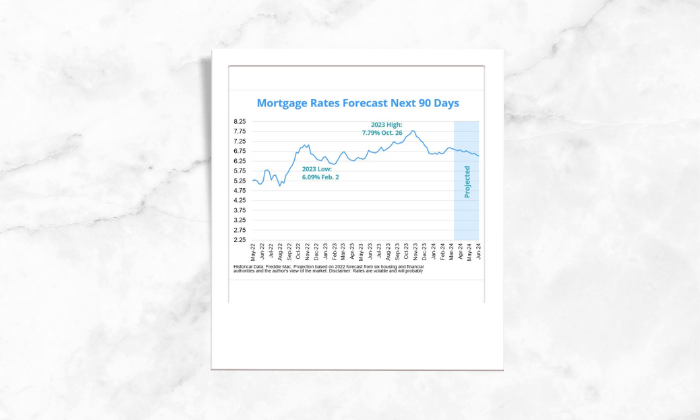

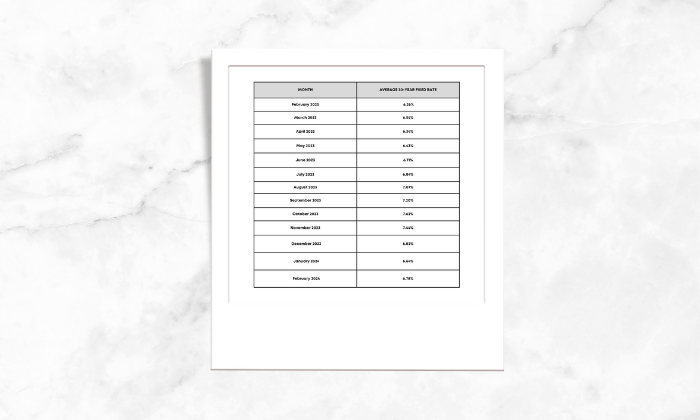

We have observed the fluctuations in Mortgage rates in 2023, with the average 30-year fixed rate going as low as 6.09% on Feb. 2 and as high as 7.79% on Oct. 26, according to Freddie Mac.

“Mortgage rates are expected to decline when Federal Reserve policymakers cut the benchmark interest rate, which is likely to happen in the second half of 2024. But as long as inflation runs hotter than the Fed would like, rates will remain elevated at their current levels.” Source-money.usnews.com

“The National Association of Realtors expects mortgage rates will average 6.8% in the first quarter of 2024, dropping to 6.6% in the second quarter, according to its latest Quarterly U.S. Economic Forecast. The trade association predicts that rates will continue to fall to 6.1% by the end of the year.” Source-money.usnews.com

“With the current stance of monetary policy holding steady, we expect mortgage rates to move sideways, remaining above 6.5% through this quarter and drifting down to about 6% by year’s end. Fannie Mae Housing Forecast. The 30-year fixed rate mortgage will average 6.3% in Q2 2024 and slowly decline over the year, landing at a Q4 average of 5.9%.” Source – Forbes.com

Experts from CoreLogic, First American and others weigh in on whether 30-year mortgage rates will climb, fall, or level off in April.

Expert mortgage rate forecasts for April

Molly Boesel, principal economist at CoreLogic

Forecast: Rates will moderate

“Slowing of inflation and the ending of the Federal Reserve’s tightening cycle suggest that the peak of mortgage rates is behind us. When Federal Reserve rate cuts begin to be priced into long-term rates, expect mortgage rates to gradually fall. Until then, the 30-year mortgage rate should remain in the high-6% range in April.”

Mark Fleming, chief economist at First American

Forecast: Rates will moderate

“Mortgage rates will likely move sideways in April, since it’s highly unlikely that the Federal Reserve will either raise or lower its benchmark rate in March. Any movement in mortgage rates is likely to depend on any changes in the 10-year Treasury yield over the course of the month.”

Rick Sharga, CEO at CJ Patrick Company

Forecast: Rates will moderate

“Mortgage rates on 30-year loans in April are likely to be very similar to the rates we’ve seen during the first quarter of 2024, fluctuating just above and just below the 7% mark. We may see rates dip a little bit lower if we get reports on inflation, unemployment, and wage growth that align with the Federal Reserve’s goal of slowing down the economy in order to get inflation firmly under control. But we’re not likely to see mortgage rates in the low 6% range until the Fed actually starts cutting the Fed Funds rate later this year.”

Mortgage interest rates forecast next 90 days

Mortgage rate forecasts for 2024

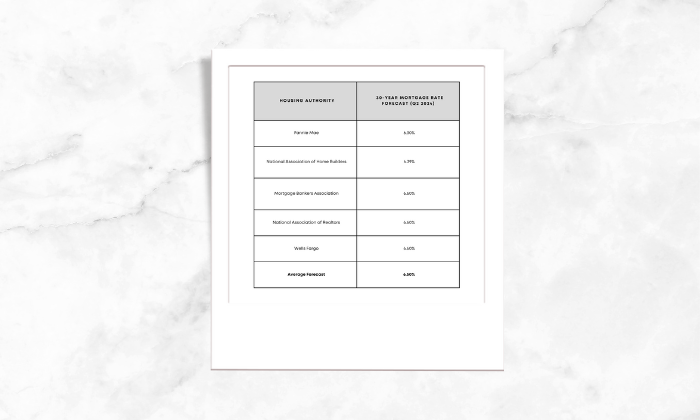

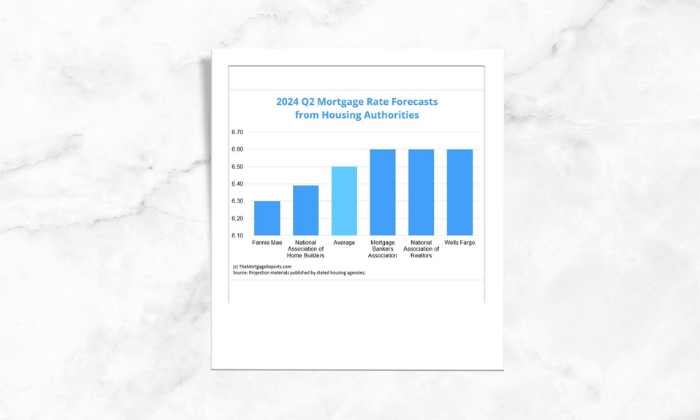

The 30-year fixed-rate mortgage averaged 6.88% as of March 7, according to Freddie Mac. All five major housing authorities we looked at project 2024’s second quarter average to finish below that.

The Fannie Mae sits at the low end of the group, predicting the average 30-year fixed interest rate to settle at 6.3% for Q2. Meanwhile, the Mortgage Bankers Association, National Association of Realtors and Wells Fargo had the highest forecast of 6.6%.

Current mortgage interest rate trends

Mortgage rates dropped after fourth consecutive weeks of increases.

The average 30-year fixed rate fell from 6.94% on Feb. 29 to 6.88% on March 7. The average 15-year fixed mortgage rate similarly decreased from 6.26% to 6.22%.

Source: Freddie Mac

In spite of volatility and rate fluctuations rates are still lowed than the highest record, thus don’t wait for lowering of rates it might turn into missed opportunity.

Contact us for a seamless experience from selection to purchase of your new dream home.

“Thanks for reading this article and for a hassle-free experience of purchase/sale of a home feel free to get in touch”.